1099 R Forms Free Download

Establishing secure connection… Loading editor… Preparing document…

- Electronic Signature

- Forms Library

- Executive Forms

- Treasury IRS Forms

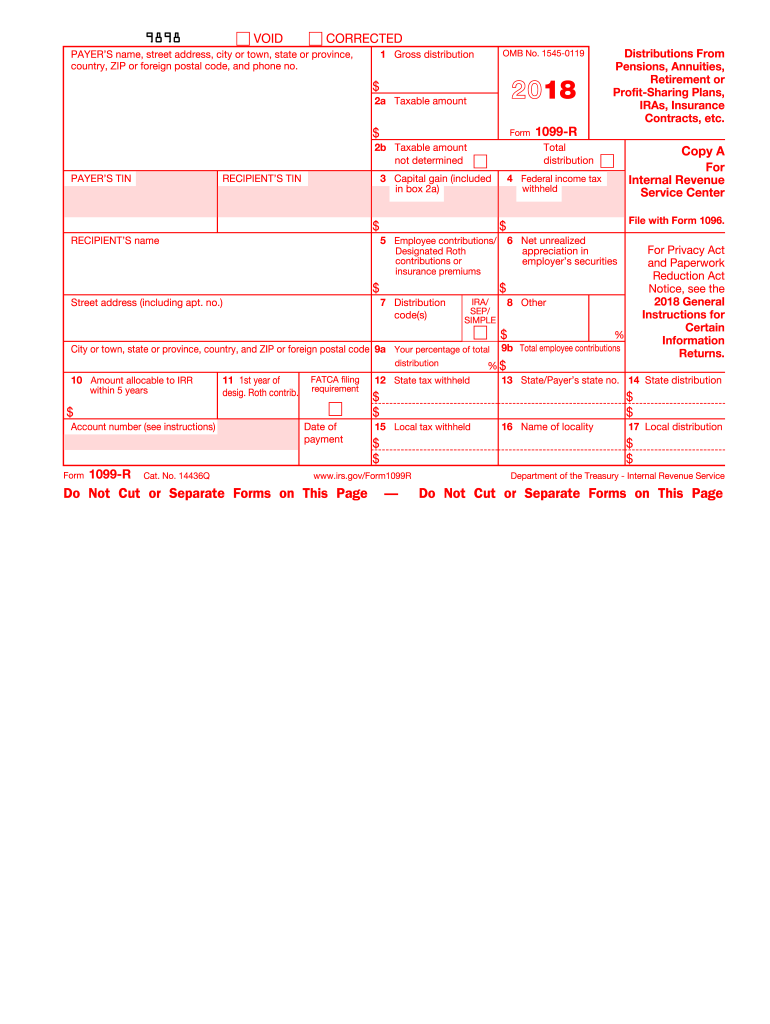

- Get and Sign 1099 R Blank 2018-2021 Form

Get and Sign 1099 R Blank 2018-2021 Form

Returns, available at www.irs.gov/form1099, for more information about penalties. Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we'll...

Show details

How it works

Browse for the 1099 r

Customize and eSign 2018 1099 r

Send out signed w 1099 form 2018 or print it

Rate the 1099 r form printable 2018

Quick guide on how to complete 1099r form

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow's web-based program is specifically made to simplify the arrangement of workflow and enhance the entire process of qualified document management. Use this step-by-step guide to complete the 1099 r 2018 form swiftly and with ideal precision.

How you can complete the 1099 r 2018 form on the web:

- To begin the document, use the Fill & Sign Online button or tick the preview image of the form.

- The advanced tools of the editor will guide you through the editable PDF template.

- Enter your official identification and contact details.

- Use a check mark to indicate the answer wherever required.

- Double check all the fillable fields to ensure total precision.

- Utilize the Sign Tool to add and create your electronic signature to signNow the 1099 r 2018 form.

- Press Done after you complete the blank.

- Now you'll be able to print, save, or share the form.

- Address the Support section or get in touch with our Support staff in case you have got any concerns.

By making use of SignNow's comprehensive solution, you're able to complete any essential edits to 1099 r 2018 form, make your personalized electronic signature in a few fast steps, and streamline your workflow without the need of leaving your browser.

be ready to get more

Create this form in 5 minutes or less

How to get a copy of 2018 1099r

Find a suitable template on the Internet. Read all the field labels carefully. Start filling out the blanks according to the instructions:

Instructions and help about print out social security 1099s 2018

Music my name is Terry White CEO of Sunwest trust and we do these videos periodically we were doing them once a week now we'll probably do them about once every two weeks so if you're interested in these videos be sure and subscribe to this channel Sunwest IRA and give us some comments if you like it if you didn't like it if you'd like some more information please leave us a comment and we'll try to get an answer to you and maybe we'll do a video based on your comment so these videos are for education purposes only they're not meant to take the place of a good CPA or tax attorney and today we're doing a little bit different video so I apologize if I'm not looking at you I'm looking at the screen I'm doing this from my desk computer so that I can pull up some documents and and guide you on a way to analyze some of the documents that some of the forms that you're going to be getting from your custodian and probably have already gotten this particular video is being done in early February

Find and fill out the correct pdf 2018 1099 r

signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out.

Versions

Form popularity

Fillable & printable

4.5 Satisfied (649 Votes)

4.4 Satisfied (109 Votes)

4.5 Satisfied (119 Votes)

FAQs find tax form 1099r

Here is a list of the most common customer questions. If you can't find an answer to your question, please don't hesitate to reach out to us.

Need help? Contact support

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of "miscellaneous" income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it's hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you'd have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I'm sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you're asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you're someone who's responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It's basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You'll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

I just received a 1099-K form from Coinbase? How do I fill my taxes?

1099-Ks from Coinbase, Gemini, and other exchanges only show your CUMULATIVE transaction value. That's why the amount may seem HUGE if you swing traded your entire balance multiple times.However you only need to pay taxes on your capital gains/losses, so that amount is likely less than the 1099K's amount. You need to file a Schedule D 1040 with a 8949.I recommend checking out Crypto tax sites like TokenTax that calculate all of that for you — Here is an article about 1099Ks from them - Coinbase Pro sent me a 1099-K. What do I do now? | TokenTax Blog

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I'll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Related searches to tax forms 1099 r

form 1099-r instructions

1099-r taxable amount not determined

1099-r taxable amount calculation

1099-r distribution codes

do i have to pay taxes on a 1099-r

1099-r and 5498

how do i get a copy of my 1099-r form

1099-r rollover

Create this form in 5 minutes!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

How to create an eSignature for the 2018 form 1099 r

Speed up your business's document workflow by creating the professional online forms and legally-binding electronic signatures.

How to generate an eSignature for your 1099 R 2018 Form in the online mode

How to create an electronic signature for the 1099 R 2018 Form in Google Chrome

How to generate an eSignature for signing the 1099 R 2018 Form in Gmail

How to create an eSignature for the 1099 R 2018 Form straight from your smart phone

How to create an electronic signature for the 1099 R 2018 Form on iOS

How to make an electronic signature for the 1099 R 2018 Form on Android OS

Related links to 1099 r fillable form

People also ask 2019 form 1099 r copy a fillable

-

Do you have to file a 1099 R on my tax return?

A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. ... The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue.

-

What does Taxable amount not determined mean on a 1099 R?

Tax Reporting: "Taxable amount not determined" is Checked on Form 1099-R Despite a Taxable Amount Being Reported. The IRS requires that we report the full amount of your IRA distribution in Box 1 (Gross distribution). ... Box 2b is checked to indicate that we have not determined the taxable amount.

-

How do I report 401k rollover on tax return?

Look for Form 1099-R in the mail from your plan administrator at the end of the year. ... Report your gross distribution on line 15a of IRS Form 1040. ... Report any taxable portion of your gross distribution.

-

How do I report RMD on my taxes?

TTax does not report any of the RMD information to the IRS. You do not actually show an RMD amount on your return. The Financial Institution or plan Administrator of your 1099-R accounts must report the year end Fair Market Value to the IRS, and should also report the FMV to you as well.

-

What tax form do I use with a 1099 R?

Form 1099-R is used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions. Anyone who makes a distribution over $10 requires a 1099-R form. The form is provided by the plan issuer.

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.

Source: https://www.signnow.com/fill-and-sign-pdf-form/468-1099-r-2018-form

Posted by: deko471.blogspot.com